Duncan's Online Sweet Shop

Buy Sweets, Treats & More; Duncan's Online Sweet Shop

Welcome to Duncan's Online Sweet Shop: Your Ultimate Destination for Confectionery Wonders

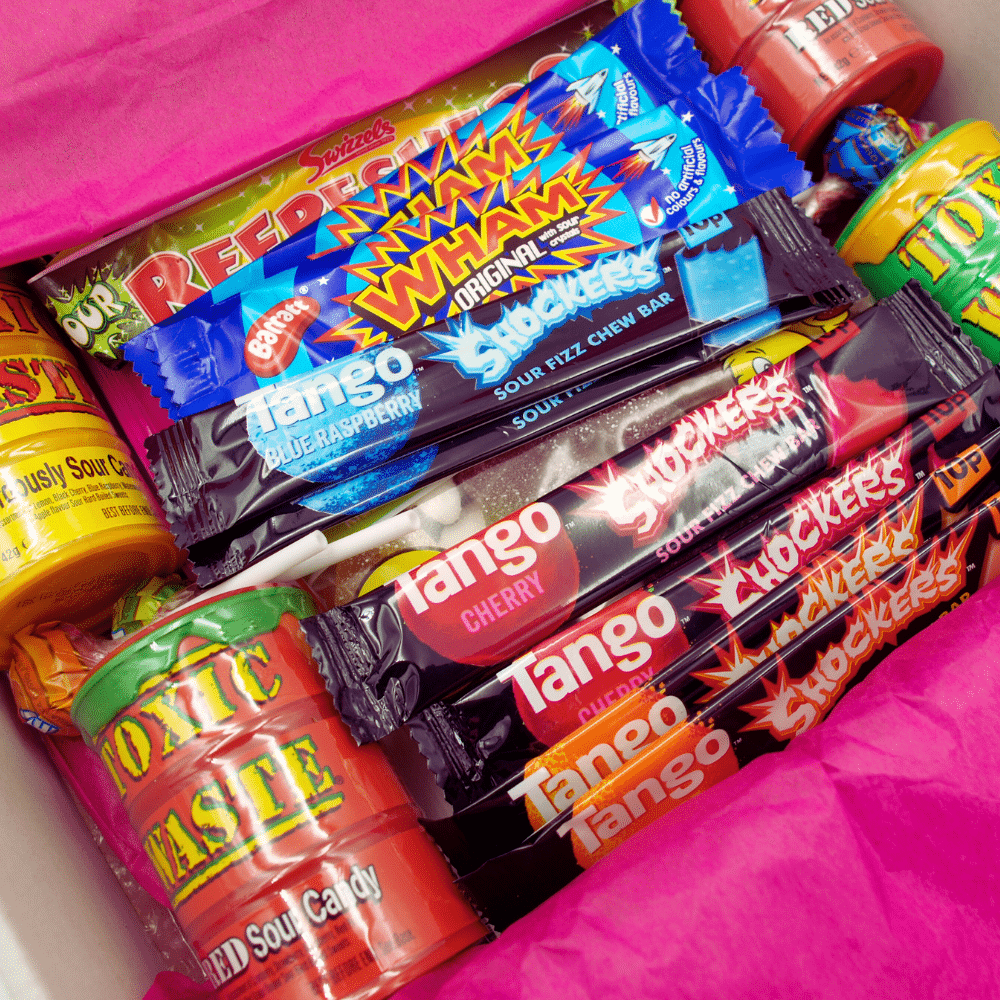

Nestled within the digital realm, Duncan's Online Sweet Shop emerges as the premier destination for sweet lovers across the UK and beyond. Embracing the heartwarming essence of a traditional sweet shop, our online store offers a seamless journey through a meticulously curated collection of pick n mix sweets, chocolate gifts, and vintage confections, all available at the click of a button.

Explore Our Exquisite Collection

Dive into the delightful world of Duncan's, your go-to Online Sweet Shop, featuring:

- Fizzy and Jelly Sweets: A sensory explosion awaits with our vibrant selection of fizzy delights and sumptuous jelly treats.

- Halal and Sour Sweets: Catering to all preferences, our assortment ranges from exquisite halal sweets to tantalizing sour sensations.

- Renowned Brands: Treat yourself to iconic names like Cadbury, Haribo, Vidal, and Swizzels, each bringing a piece of confectionery history to your doorstep.

- Retro Sweets, Sherbet, and More: Relive the golden days with our selection of retro sweets, complete with the joyous fizz of sherbet, a hallmark of classic British sweets.

- Vegan Sweets: Our vegan collection, including vegan pick n mix, offers cruelty-free delights, ensuring there's something special for everyone.

Why Shop With Duncan's Online?

At Duncan's Online Sweet Shop, we uphold the tradition of the artisanal sweet shop experience, with a modern twist. Every confectionery, be it sweet tubs, sweet jars, or bespoke sweet hampers, is selected and packaged with the utmost care. Our commitment to personalized service makes our online store the perfect haven for finding the ideal gift for any occasion, from birthday presents to next-day delivery surprises.

Experience the Magic of Duncan's Online Sweet Shop

Step into the enchanting world of Duncan's Online Sweet Shop, where tradition meets convenience. From bulk sweets to Cadbury selection boxes, and from lollipops to candy floss, embark on a sweet journey that transcends time and space, all from the comfort of your home. Discover the unparalleled selection, convenience, and charm of shopping with Duncan's, where every click brings you closer to the sweetest memories of yesteryear, reimagined for today's world. Visit us online for an unmatched confectionery adventure, marking the beginning of a sweet and delightful journey with Duncan's Online Sweet Shop.

Next Day Delivery Gifts

Sweet Express Service

Gift Wrap

Gift Wrap Service Available

Personalise

Add a Personalised Message